Bitcoin’s four-year cycle has historically dictated its market behavior, leading to price surges and corrections. The 2024 halving proved no different, propelling Bitcoin to the remarkable $100K milestone. Will the cycle repeat, or is this the turning point for the world’s leading cryptocurrency? Let’s explore its impact and future trajectory.

For years, Bitcoin’s four-year cycle has fascinated investors and analysts. Each halving event has historically triggered substantial price movements, making it one of the most anticipated moments in the crypto world. The 2024 halving followed suit, pushing Bitcoin to an all-time high of $100K. But as market dynamics evolve, we must ask: will this pattern hold, or are we witnessing the beginning of a new era?

💰 Why does Bitcoin’s supply remain predictable? Unlike traditional fiat currencies, where central banks control issuance, Bitcoin operates on a transparent and predetermined schedule. Anyone can verify how many Bitcoins exist at any moment and how many will be created in the future.

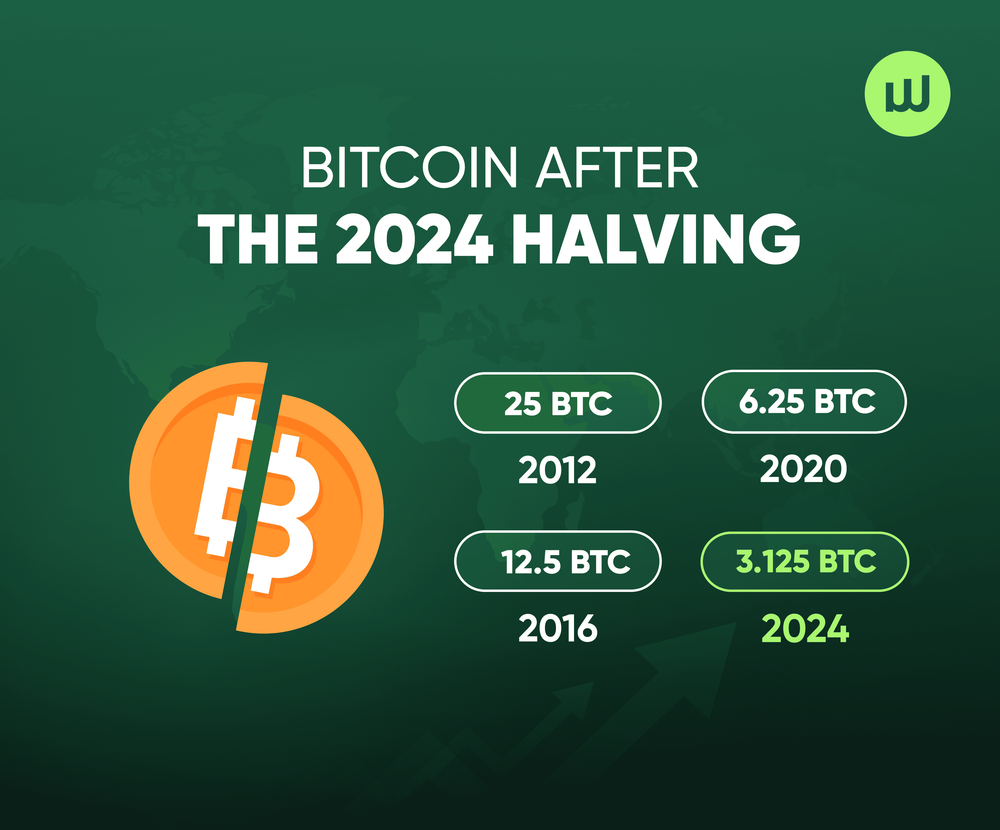

📊 The power of a fixed supply With a hard cap of 21 million coins, Bitcoin’s scarcity has long been a major factor in its valuation. Every four years, the number of new Bitcoins entering circulation is reduced, reinforcing its deflationary nature.

🔗 What is the halving event? Every 210,000 blocks (approximately every four years), Bitcoin’s block reward for miners is halved. This event reduces the rate at which new BTC is introduced into the market, impacting supply and influencing price trends.

📈 How did the 2024 halving impact Bitcoin’s price? Historically, halvings have preceded bullish cycles. The 2024 event was no exception—Bitcoin surged past $100K, fueled by increased institutional interest, macroeconomic shifts, and demand outpacing supply.

🔍 Will the four-year cycle continue? While past patterns suggest further growth, Bitcoin’s evolving adoption, new financial products (like ETFs), and regulatory landscapes could influence market behavior in unprecedented ways.

💡 What are Bitcoin spot ETFs? A spot ETF allows investors to gain exposure to Bitcoin without directly purchasing and holding it. Unlike futures-based ETFs, these funds track Bitcoin’s actual price, offering more direct market access.

📊 How did ETFs impact Bitcoin post-halving? With the approval of Bitcoin spot ETFs in major financial markets, institutional investors poured billions into the asset, further driving its post-halving price momentum.

🏛 Pro-Crypto Policies and Regulatory Clarity With Donald Trump’s return to the presidency in 2025, the U.S. government has taken a more favorable stance on cryptocurrencies. His administration has hinted at clearer regulatory frameworks that encourage blockchain innovation and institutional adoption.

📉 Deregulation and Institutional Confidence Under Trump’s leadership, financial deregulation efforts have given major institutions greater confidence in investing in Bitcoin. This shift has accelerated the influx of capital into Bitcoin spot ETFs, further contributing to the post-halving price surge.

🔍 Potential Challenges: CBDCs and Market Oversight Despite Trump’s pro-crypto stance, his administration remains skeptical of Central Bank Digital Currencies (CBDCs), positioning Bitcoin as a decentralized alternative. However, regulatory oversight on exchanges and stablecoins could still pose challenges for the broader crypto market.

📊 What’s Next for Bitcoin Under Trump? As the administration continues to shape financial policies, investors and analysts will closely watch how regulatory clarity, institutional adoption, and macroeconomic strategies influence Bitcoin’s long-term trajectory.

💰 Is now the time to buy Bitcoin? Bitcoin’s historical performance suggests accumulation periods following halving events can yield substantial returns. However, market conditions and external factors should always be considered.

⚖️ Reducing volatility with DCA (Dollar-Cost Averaging) DCA is a popular strategy where investors buy small amounts of Bitcoin at regular intervals, mitigating price swings and building long-term exposure.

Bitcoin’s 2024 halving once again reshaped the market, pushing its price past the $100K milestone. However, as institutional adoption grows and financial products evolve, we may be entering a new era where historical cycles become less predictable. One thing remains certain—Bitcoin’s role in the global financial system continues to strengthen.

Stay updated with the latest news, tips, and exclusive information